How Financial Leverage Explains the Difference Between Roa and Roe

Financial over-leveraging means incurring a huge debt by borrowing funds at a lower rate of interest and using the excess funds in high risk investments. The balance sheets fundamental equation shows how this is.

Return On Equity Roe Formula Examples And Guide To Roe

This equation uses net operating assets which equals total assets less the non-interest-bearing operating liabilities of the business.

. Is greater FLEV always better. The moment there is some leverage in the balance sheet the gap between ROCE and ROE is narrowed as ROE is enhanced from 105 to 114. We can summarize the exact relationship among ROE ROA and leverage in the following equation1.

In 2013 banking giant Bank of America Corp BAC reported an ROA level of 050. One way to increase ROE is to decrease equity. Its financial leverage was 960.

The correct answer is C. Debt is included in ROA which can be clearly seen in the balance sheetTotal Assets Liabilities Shareholders Equity. By taking on debt a company increases its assets thanks to the cash that comes in.

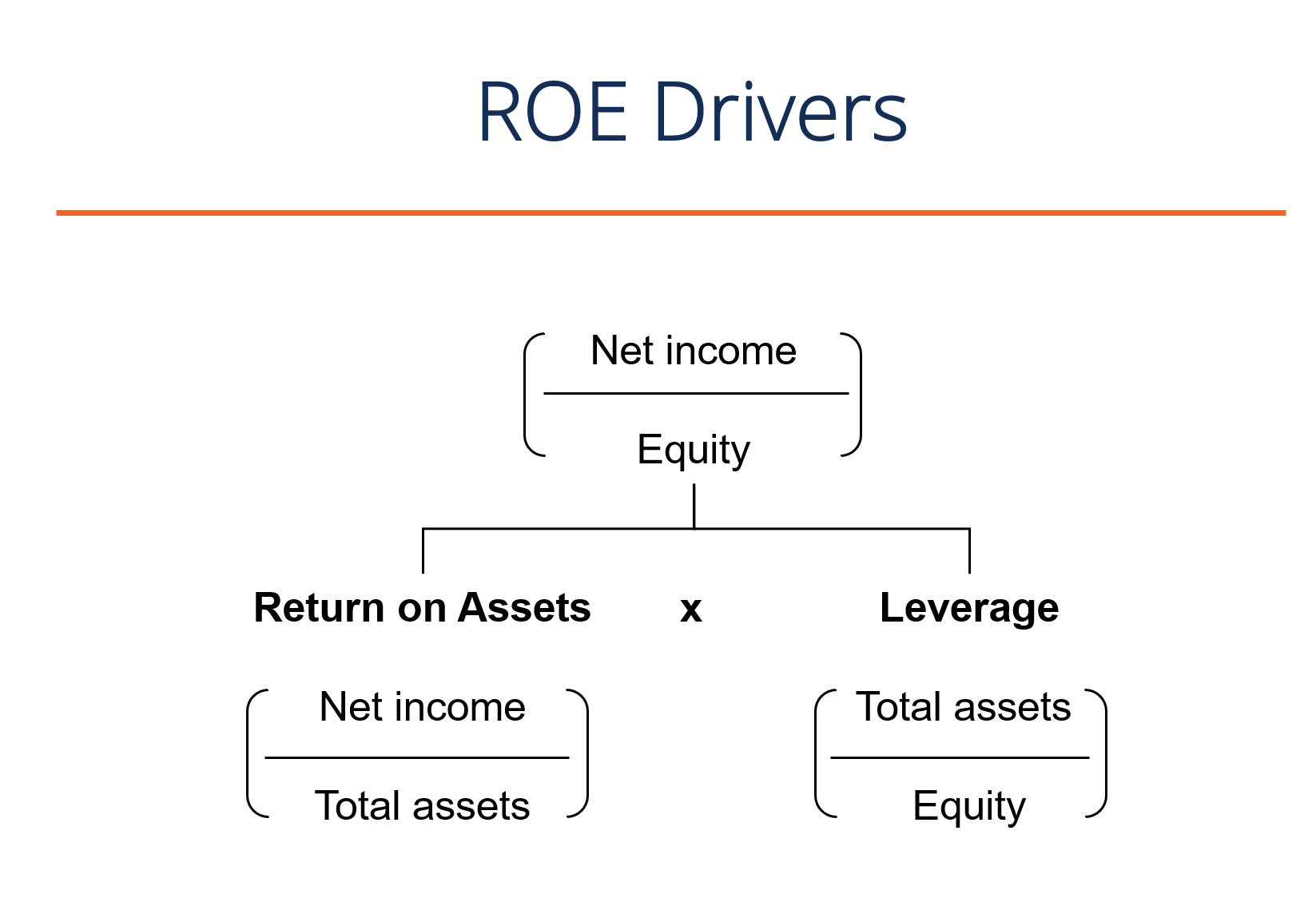

ROIC Return On Invested Capital is calculated as the sum of after-tax interest expense plus net income divided by the sum of debt plus equity. Now if the company decides to take a loan ROE would become greater than ROA. Return on equity ROE helps investors gauge how their investments are generating income while yield on assets ROA helps investors measure how management is using its assets or resources to generate more income.

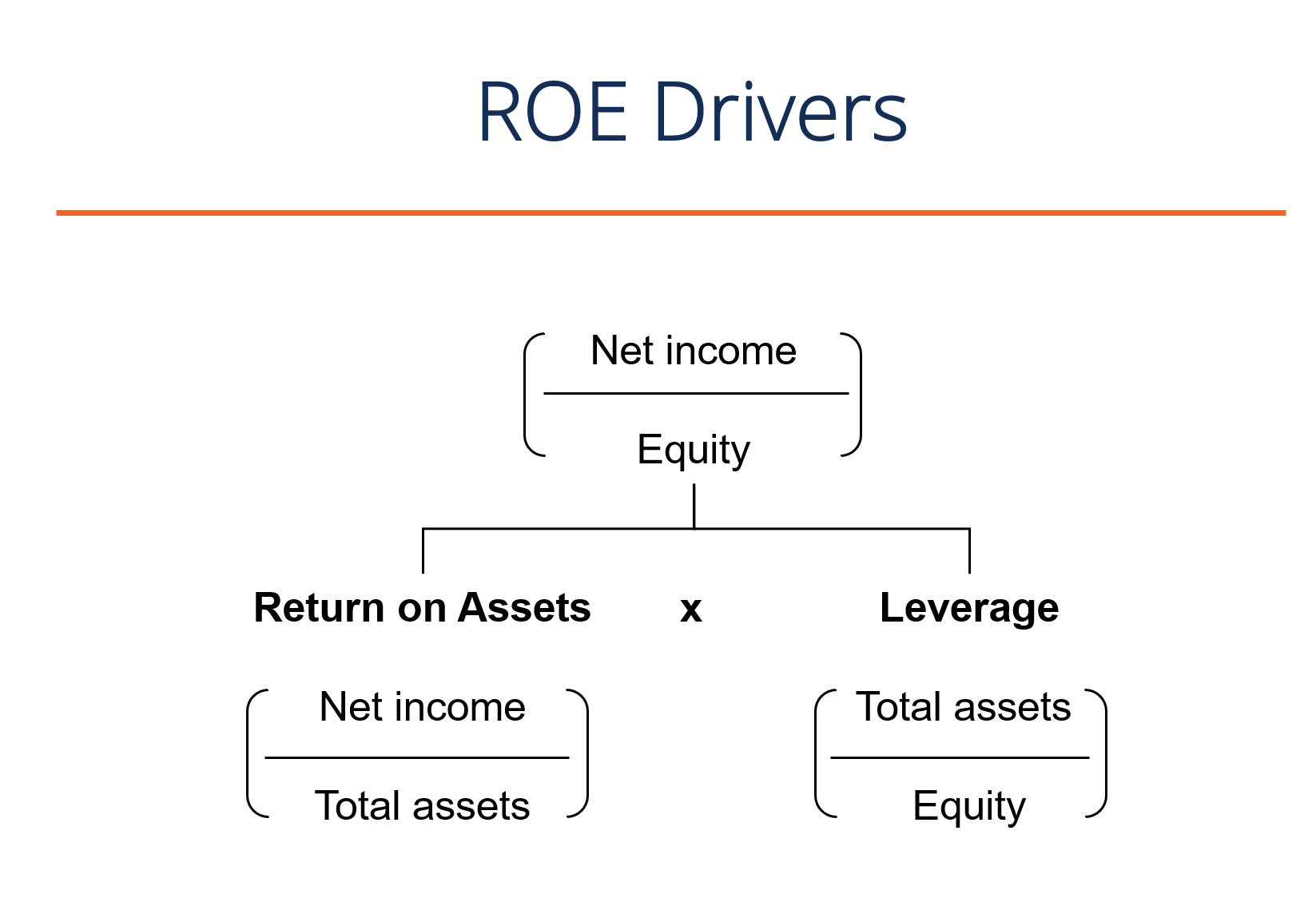

This means that in this scenario ROE and ROA will be equal. Assuming returns are. By splitting ROE return on equity into three parts companies can more.

A higher ROE is not always an indicator of an impressive. An increase in financial leverage always results in a decrease in a companys net income and return on equity. The relationship has the following implications.

3 What is the difference between the traditional ROA measure part of the traditional DuPont analysis and the return on net operating assets RNOA. Operating income is income earned before taxes. Financial leverage means using someone elses money instead of equity for part of the capital of a business.

While ROE looks at how much profit is generated in relation to equity ROIC looks at both equity and debt. ROIC or return on invested capital is another indicator of how well a company is doing. Leverage Risk and Misconceptions.

EBIT Net operating assets ROA. ROA and ROI are two vital measures that can be used in this exercise. 5 Explain the.

Higher the leverage narrower the gap between ROE and ROCE finally if the company is highly leveraged ROE will be higher than ROCE due to smaller contribution of equity capital in companys capital structure. If the risk of the investment outweighs the expected return the value of a companys equity could decrease as stockholders believe it to be too risky. 4 Explain how return on net operating assets RNOA and financial leverage FLEV affect Return on Equity ROE.

Debt is not included in ROE or we can say that ROE does not contain any kind of debt. As you can see equations 1 and 2 yield the same result. Asset Turnover 60420 67982 08888 8888.

The calculations are pretty easy. Return on equity ROE helps investors gauge how their investments are generating income while return on assets ROA helps investors measure how management is using its assets or resources to generate more income. ROE Return on Equity is basicly profit divided by equity.

The major factor that separates ROE and ROA is financial leverage ie. Another method of determining the return on investment is to divide operating income by average operating assets. ROA Return On Assets calculates how much income is generated as a proportion of assets while ROI Return On Investment measures the income generation as opposed to investment.

This is the key difference between ROA and ROI. Heres how to calculate the return on assets ROA ratio. Return on Equity ROE is generally net income divided by equity while Return on Assets ROA is net income divided by average assets.

2The formula for ROE is net income after taxes divided by shareholder equity while the formula for RNOA is net income divided by total assets. Essentially ROIC is a different calculation used to give an idea of. Financial leverage increases the variability of a companys net.

In the DuPont equation ROE is equal to profit margin multiplied by asset turnover multiplied by financial leverage. But what do they mean. One major difference between ROE and ROA is debt.

Return on equity ROE helps investors gauge how their investments are generating income while return on assets ROA helps investors measure how management is using its assets or resources to generate more income. If there is no debt shareholders equity and total assets of the company will be same. ROA Net Profit Margin Asset Turnover 2926 8888 2601.

If there is no debt or if the firms ROA equals the interest rate on its debt its ROE will simply equal 1 minus the tax rate times ROA. But if that company takes on financial leverage its ROE would be higher than its ROA. ROIC calculates how efficient a company is at using capital to generate profit.

In 2013 banking superhuman Bank of America Corp. ROA tends to tell us how effectively an organization is taking earnings advantage of its base of assets. The big factor that separates ROE and ROA is financial leverage or debt.

If its ROA exceeds the interest rate then its ROE. Accounting questions and answers. ROE Return On Equity is calculated as net income divided by equity.

A good part of a businesss net income for the year could be due to financial leverage. 1ROE is Return on Equity while RNOA is Return on Net Operating Asset. The major factor that separates ROE and ROA is financial leverage ie.

There you have it. Under DuPont analysis return on equity is equal to the profit margin multiplied by asset turnover multiplied by financial leverage. ROA Return On Assets is calculated as net income divided by assets.

An increase in financial leverage may result either in an increase or decrease in a companys net income and return on equity.

Roi Vs Roe All You Need To Know

What Is The Dupont Method Consultant S Mind

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Dupont Roe Calculation Financial Leverage Return On Assets Roa Explained Driveyoursucce

Comments

Post a Comment